[2020-07-19]中国的经济规模有多大?巨无霸指数表明中国经济规模比世界银行认为的要大

文章原始标题:How big is China’s economy? Big Mac suggests China’s economy bigger than the World Bank thinks

国外来源地址:https://defence.pk/pdf/threads/how-big-is-chinas-economy-big-mac-suggests-chinas-economy-bigger-than-the-world-bank-thinks.676203/

该译文由蓝林网编辑,转载请声明来源(蓝林网)

内容简介: 巨无霸指数是通过比较麦当劳在各国的快餐店销售巨无霸的价格,来比较国与国之间的购买力平价。类似义乌指数... - _ -

How big is China’s economy? Let the Big Mac decide

Our index reckons China’s economy is bigger than the World Bank thinks

中国的经济规模有多大?让巨无霸指数来决定吧。

我们的指数认为中国的经济规模比世界银行认为的要大。

AMERICA'S ECONOMY did not exceed China in size until the 1880s, according to the Maddison Project at the University of Groningen. The two now rival each other again. Because China’s workers are 4.7 times as numerous as America’s, they need be only a fraction as productive to surpass America’s output. No fewer than 53 countries would already have a bigger GDP than America if they were as populous as China.

根据格罗宁根大学麦迪逊项目的数据,美国经济规模直到19世纪80年代才超过中国。然而,这两个国家现在又开始互相竞争了。因为中国的工人数量是美国的4.7倍,他们的生产力只需要超过美国一点点,就能超过美国的产出。如果其他国家的人口和中国一样多的话,至少会有53个国家的 GDP 已经超过了美国。

In 2019 China’s workers produced over 99trn yuan-worth of goods and services. America’s produced $21.4trn-worth. Since 6.9 yuan bought a dollar last year, on average, China’s GDP was worth only $14trn when converted into dollars at market rates. That was still well short of America’s.

2019年,中国工人生产了价值超过99万亿元人民币的商品和服务。美国的产值为21.4万亿美元。自从去年人民币6.9元兑换1美元以来,按市场汇率换算成美元,中国的国内生产总值(GDP)平均只值14万亿美元。这仍然远远低于美国。

But 6.9 yuan stretches further in China than a dollar goes in America. One example is the McDonald’s Big Mac. It costs about 21.70 yuan in China and $5.71 in America, according to prices collected by The Economist. By that measure, 3.8 yuan buys as much as a dollar. But if that is the case, then 99trn yuan can buy as much as $26trn, and China’s economy is already considerably bigger than America’s.

但是在中国6.9元比在美国1美元更有价值。麦当劳的巨无霸就是一个例子。根据《经济学人》收集的价格,它在中国的售价约为21.70元,在美国约为5.71美元。按照这个标准,3.8元等于1美元。但如果是这样的话,那么99万亿人民币可以买到多达26万亿美元的东西,中国的经济规模已经大大超过美国。

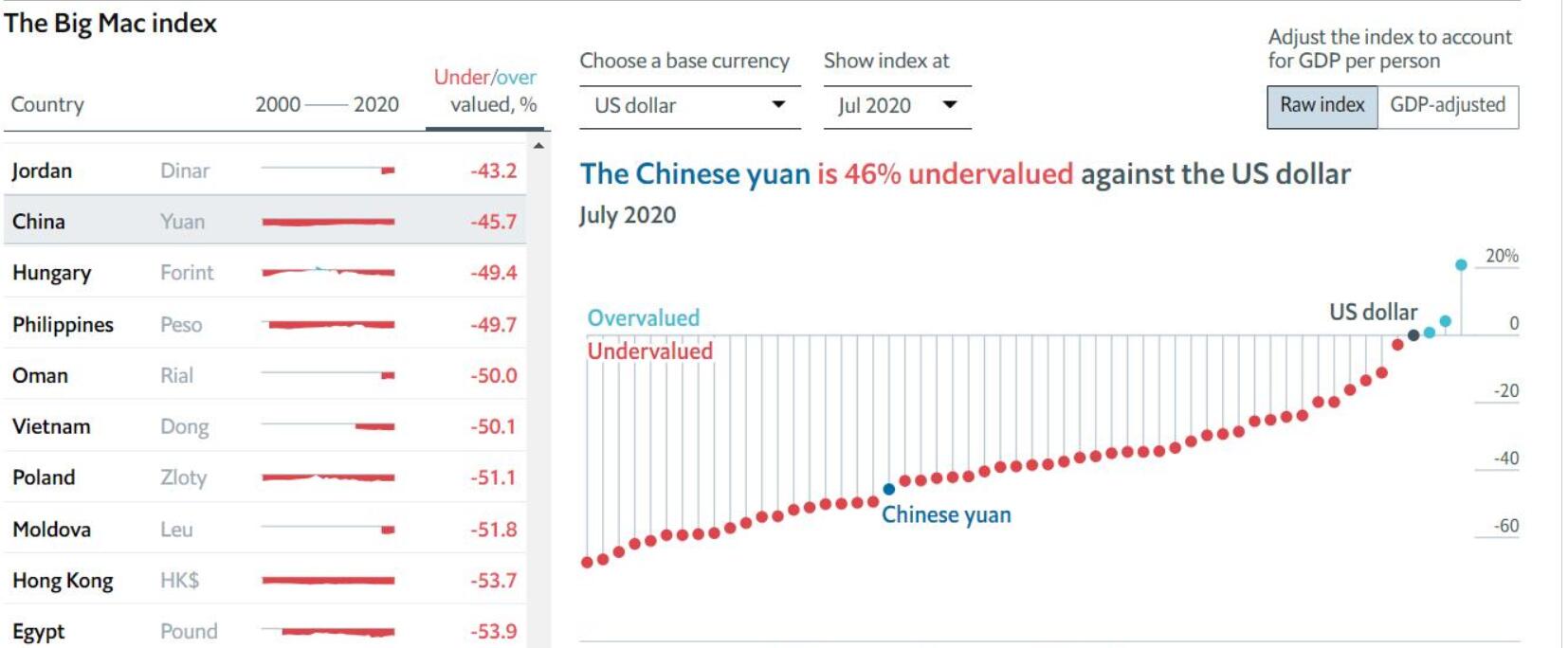

Motivated by this logic, The Economist has compared the price of Big Macs around the world since 1986. The result is a rough gauge of the purchasing power of currencies. It suggests that many currencies are undervalued, relative to the dollar, on the foreign-exchange markets (see chart). A few, such as the Swiss franc, are overvalued. Lebanon’s pound was undervalued until inflation took off late last year, raising local prices even as the pound remained pegged to the dollar. The Big Mac alone jumped 38% in price.

基于这种逻辑,《经济学人》杂志从1986年开始比较全球巨无霸的价格。其结果是对货币购买力的粗略估计。这表明,在外汇市场上,许多货币相对于美元被低估了(见图表)。一些货币,例如瑞士法郎等被高估了。黎巴嫩镑一直被低估,直到去年年底通货膨胀才开始上升,尽管黎巴嫩镑仍然与美元挂钩,但当地价格也随之上涨。仅是巨无霸的价格就上涨了38% 。

Every few years the World Bank embarks on a vastly more systematic effort to gauge purchasing power by comparing thousands of prices across the world. The results can be startling. Its survey of prices, released six years ago, showed that China was cheaper than previously thought and its economy was therefore much larger. Based on these estimates, the IMF calculated that its GDP overtook America’s in 2014 and was 27% bigger in 2019.

每隔几年,世界银行就会着手进行一项更加系统化的努力,通过比较全球数千种价格来衡量购买力。结果可能会令人吃惊。六年前发布的物价调查显示,中国的物价比之前认为的要便宜,所以其经济规模要大得多。基于这些估计,国际货币基金组织计算出中国的GDP在2014年已经超过了美国,2019年超过了27% 。

Many observers, however, greeted these estimates with scepticism. In 2010 an informal survey by a reporter at Caixin, a financial magazine, noted that a number of items were dearer in Hangzhou than in its sister city Boston. (It compared apples to apples, and found that the Golden Delicious variety was 37% pricier in the Chinese city.)

然而,许多观察家对这些估计持怀疑态度。2010年,金融杂志《财新》的一名记者进行了一项非正式调查,结果显示,杭州的一些商品比其姐妹城市波士顿更贵。(比较了苹果,发现金冠苹果在中国的价格高出37%)

The sceptics won some vindication in May when the World Bank released its latest price-comparison exercise. It discovered that things were about 17% more expensive in China, relative to America, than previously thought. At a stroke, China’s GDP fell by over $3.2trn. The estimates suggest China did not overtake America’s economy until 2016.

今年5月,当世界银行发布最新的价格比较报告时,这些持怀疑态度的人赢得了一些证明。研究发现,与美国相比,中国的商品价格比之前预计的要贵17%。中国的GDP一下子下降了3.2万亿美元。这些估计数字表明,中国直到2016年才超过美国经济。

But are these new estimates any more robust than earlier efforts? Comparing prices across the world is fraught with difficulties. An item may be a staple in one place and a delicacy in another. The World Bank must also decide how much weight to give each item. That depends on shopping habits, which differ—partly because prices differ. It is easy to go around in circles.

但是,这些新的估算是否比以前的结果更有说服力?比较世界各地的价格充满了困难。一件东西在一个地方可能是主食,在另一个地方可能只是美味食物。世界银行还必须决定每件东西的权重。这取决于不同的购物习惯,部分原因是价格不同。绕圈子很容易。

So it might help to check the World Bank’s results against a cruder yardstick—like the price of a Big Mac. Our index suggests that the bank now, if anything, underestimates the buying power of China’s currency, and therefore its economic size. McDonald’s was once a symbol of America’s economic might. Now the Big Mac shows how its might is being surpassed.

因此,将世界银行的结果与一个更为简单的指数(比如巨无霸的价格)进行比较,或许会有所帮助。我们的指数表明,如果有什么不同的话,那就是现在世界银行低估了中国货币的购买力,所以也低估了中国的经济规模。麦当劳曾经是美国经济实力的象征。现在,巨无霸指数展示了它的实力是怎么被超越的。

网友评论:

beijingwalker

That's why Americans seem to make much more money per capita wise on paper, but have trouble to make their ends meet, while Chinese make less money but still can save much of the earnings without hurting a decently comfortable life.

这就是为什么美国人在纸面上的人均收入似乎要高得多,但却难以维持收支平衡,而中国人虽然挣的钱较少,但仍然可以在不影响舒适生活的情况下节省大部分收入。

Tumba

Big Mac index basically relates to actual purchasing power, definitely one dollar in US cant buy you much in home country as services and even local commodities are much expensive on other hand in developing countries one dollar goes a long way..

I cant find anything for one dollar decent enough to eat in USA for one dollar in India I can have decent lunch with 3 course meal beat that...

China is getting expensive though still definitely much better purchasing power locally for one dollar I can imagine

巨无霸指数基本上与实际购买力相关,一美元绝对不能在本国买很多东西,因为服务费甚至本地商品都很贵,在发展中国家,一美元可以花更久...

我在美国找不到一美元就能吃到的东西,在印度我只要一美元,就可以吃到一顿像样的三道菜午餐。

但中国物价正在上涨,我仍然可以想象一美元在当地的购买力肯定要好得多。

beijingwalker

Chinese can afford being locked down for years cause saving can last us very long, A lockdown in US for 2 months will force many Americans onto the streets begging for food.

中国人可以承受数年的封锁,因为可以持续很长时间储蓄,美国封锁两个月将迫使许多美国人上街乞讨食物。

GumNaam

trump be all like: what does a burger know about ecomanomics! :lol:

特朗普会像这样说“一个汉堡包懂个屁经济学!”哈哈

beijingwalker

It varies from place to place, see how cheap Xinjiang is!! I'll say people in Xinjiang can make many times less money than Beijing but still enjoy a better life than Beijingers.

Tourist shocked by cost of living and local price in Xinjiang

0.7$ a bowl of milk tea and naan bread is free, Several different kinds of naans, cheese flavor, rose flavor, onion flavor... and they are all you can eat...

每个地方都不一样,看看新疆的物价有多便宜!!我要说的是,新疆人挣的钱比北京人少很多,但仍然比北京人过得好。

游客会对新疆的生活成本和当地的物价感到震惊。

一碗奶茶0.7美元,烤饼是免费的,有几种不同的烤饼,奶酪味,玫瑰味,洋葱味... 你想吃多少就吃多少...

Tumba

couldn't agree with u more, definitely even in India one can find much more in Tier 2-4 cities in one dollar than in Tier 1-2 cities same surely true everywhere ...

I get decent pizza of 300 rupee in Tier 1 city in India

Same I used to get for 18 USD plus tip in USA

Same might be smwht better pizza I can order in Tier 3 city for 200 rupee haha

我完全同意你的观点,即使是在印度,一美元也可以在二四线城市买到比一二线城市多得多的东西,在任何地方都是一样的。

在印度的一线城市,我可以用300卢比买到像样的披萨。

在美国,我用18美元买过同样的披萨外加小费。

在印度三线城市,我可以花200卢比买到更好的比萨饼 哈哈

tower9

It's not just about earnings but cultural values. Chinese people work, come home and save money to invest. Americans get paid on Friday and blow it on a steak dinner, at the bar and the strip club.

这不仅关乎收入,还关乎文化价值。中国人工作,回家,存钱投资。美国人在星期五拿到工资,却在酒吧和脱衣舞俱乐部的牛排晚餐上挥霍掉了。

Leishangthem

That cuture is actually good for economy in some way,though not in all scenarios.

All gov tries to make their civilians splur more and more of their extra savings.

从某种程度上来说,这种方式实际上对经济有利,尽管不是在所有情况下都是如此。

所有的政府都努力让他们的公民花掉越来越多的额外储蓄。

Viet

Big Mac is not a proper measurement.

Here fast foods are cheap.

Even cheaper if you use coupon from the weekly newspaper.

If following that Big Mac standard then Germany is either very poor or very rich. Or both.

巨无霸指数不是一个恰当的衡量标准。

这里的快餐很便宜。

如果你使用周报上的优惠券,甚至更便宜。

如果遵循巨无霸的标准,那么德国要么非常贫穷,要么非常富有,或者两者兼而有之。

Shinigami

The impressive chinese economy is a lie fabricated by the China for "face"

让人印象深刻的中国经济就是中国为了“面子”而编造的。

beijingwalker

Come to China and see how is life here and what's China's infrastructure is like and then tell me they are all fake

This is what really matters now under this current situation, and this is the reason how China can largely wiped out the virus in just couples of months so successfully. US can never afford a long lockdown and that's why even the infection rate keeps breaking record, US still has to open up.

来中国,然后看看这里的生活是怎样的,中国的基础设施是什么样的,然后告诉我这些都是假的。

这是当前形势下,真正重要的事情,也是中国如何能够在短短几个月内成功遏制这种病毒的原因。美国永远承受不起长期的封锁,这就是为什么即使感染率一直打破纪录,美国仍然要重开。

BHAN85

There is no massive advertising in China.

I've seen CGTN and I never see a advertising on that tv channel. Like in Cuban television, it's because they are communists countries.

Han Chinese in Taiwan are saving money so much as in PRC?

High class chinese people love to buy useless expensive and luxury things so much as the westerners or even more, but they can afford it.

在中国没有大规模的广告。

我看过中国的 CGTN 电视台,但我从来没有在那个电视频道上看到过广告。古巴的电视节目也一样,这是因为他们是共产主义国家。

在台湾的汉族人和在中国大陆的汉族人都一样存钱的吗?

中国的上层人士和西方人一样喜欢购买没用、昂贵、奢侈的东西,甚至买更多,但是他们买得起。

tower9

Advertising is everywhere in China. It's more in your face than in the West.

广告在中国无处不在,比在西方更显眼。

BHAN85

In the TV too?

电视上也有吗?

tower9

It's everywhere. They have far less boundaries when it comes to advertising than in the west. Even in elevators, in their subways, everywhere, there is advertising non stop. It's actually annoying to me.

无处不在。在广告方面,他们的界限比西方国家要宽松得多。甚至在电梯里,地铁里,到处都有不停的广告。这实际上让我很烦恼。

BHAN85

But in the CGTN channels television there is no advertising, no?

There is commercial television advertising in China in CGTN (former CCTV) or another channels?

Elevators, subways, etc... it's only for big cities.

但是在CGTN频道的节目里没有广告,不是吗?

中国CGTN(原CCTV)里有商业广告吗,或者任何频道?

电梯,地铁等... 只在大城市广告才遍地存在。

tower9

They have tons of tv channels not just cgtn. That’s mainly for foreigners. Most of their other tv channels are not political and very commercialized.

他们有成千上万的电视频道,不仅仅是CGTN。那个频道主要是为外国人准备的。他们的其他大多数电视频道都不是政治性,而且非常商业化。

Yankee-stani

CGTN is slightly better than what they had before I remember it was CCTV9 it was horrible back in the late 2000s so many Chinglish mistakes then they started hiring foreigners or folks from the Chinese diaspora

CGTN比他们之前那个频道要好一些,我印象中是叫CCTV9,在2000年代末那时很糟糕,有很多中式英语的错误,然后他们开始雇佣外国人或者中国侨民来报道。

Nilgiri

Yah thats basically it.

But they will dissuade any use of same PPP concept for Indian economy though.

Its all very selective and inconsistent by them..... they are propaganda driven, not logic driven.

基本上就像文章所说的。

但是,他们会劝阻印度使用同样的购买力平价概念。

这些都非常有选择性,前后矛盾... 他们是以宣传为驱动,而不是以逻辑为驱动。

Leishangthem

China will be close to 80% of US economy by the end of 2020;nominal .

China would be the number one economy by a massive margin by PPP, it does help when facing a crisis like we are experiencing now.

But this crisis will pass and cannot be a norm forever, when the world is back to normal, it's still nominal GDP matters more when doing global trade, China is the world biggest trading nation, so care more about nominal GDP.

到2020年底,中国将接近美国经济的80%,名义GDP。

按购买力平价计算,中国将以巨大优势成为世界第一经济体,当我们面临现在这样的危机时,这的确有所帮助。

但是这场危机终将会过去,不可能成为永远常态,当世界恢复正常时,在全球贸易中名义GDP仍然更重要,中国是世界上最大的贸易国,所以更关心名义GDP。

zectech

This is what the trump site - zerohedge - believes about trumps economy.

Prominent pro-trump Zerohedge quoted from this ShadowGvtStats to discredit Obama back in 2016, so they believe ShadowStats was valid them.

By this ShadowStats, China surpasses USA in nominal GDP years ago.

Fake Jobs Plague The U.S. Economy

Record stock market, raised by endless debt

这就是特朗普的支持网站“zerohedge”对特朗普经济的看法。

2016年,它引用了ShadowGvtStats网站的一段话来诋毁奥巴马,所以他们相信ShadowStats网站是正确的。

根据ShadowStats的数据,中国的名义GDP在几年前就已经超过了美国。

假工作困扰美国经济,创纪录的股票市场,由无止境的债务支撑。

Han Patriot

PPP means nothing if half your population openly defecate and 25% are starving. That's the main reason we are ridiculing india. Of course we know RMB is undervalued, we are doing it deliberately to destroy Western industrial base just like what the Japs did.

如果一半的人口露天排便,四分之一的人处于饥饿状态,购买力平价就毫无意义了。这就是我们嘲笑印度的主要原因。当然,我们知道人民币被低估了,这样做是为了像日本那样摧毁西方的工业基础。

beijingwalker

Sometimes I really wonder what US still has besides their massively bloated stock market, US doesn't have much heavy industries left, heavy industries still produce steel and other essential material to support all other industries, US has little manufacturing and the infrastructure, public facilities of all kinds are falling apart and way behind China's, so called high tech US also vastly depends on China, without China it can not even build their 5G network... Yes US is still the biggest weapon producer but which countries are always fighting wars?

有时候,我真的很想知道,美国除了他们庞大臃肿的股票市场,还有什么,美国的重工业已经寥寥无几了,重工业生产了钢铁和其他支持所有其他工业的基本材料,美国几乎没有制造业和基础设施,各种公共设施正在分崩离析,远远落后于中国,所谓的高科技美国也大大依赖中国,没有中国甚至不能建立他们的5G网络... 是的,美国仍然是最大的武器生产国,但哪些国家总是在打仗?

PPP GDP is usually used to measure per capita domestic purchasing power, while nominal GDP is used to measure global purchasing power and influence.

Anyway it's stupid to say a local currency is overvalued or undervalued by just looking at the PPP index.

The Swiss Franc for example is strong relative to the USD, but it doesn't mean that it's overvalued. The strong Franc is rooted in Switzerland's strong economic fundamentals. In fact it should appreciate even further if the government didn't squirrel away the accumulated surplus in foreign reserves.

购买力平价通常用于衡量人均国内购买力,而名义GDP则用于衡量全球购买力和影响力。

无论如何,只看购买力平价指数就说本币被高估或低估是很不合理的。

例如,瑞士法郎相对于美元是强势的,但这并不意味着它被高估了。瑞士法郎的坚挺源于瑞士强劲的经济基本面。事实上,如果政府不把累积的外汇储备盈余存起来,它应该会进一步升值。

the_messenger

GDP PPP, sometimes, is an illusion.

It only has some meaning in case that country can produce many things for itself. For the case of China where they can produce nearly everything, PPP has a big meaning.

For others, it only shows the country has a very large wealth gap.

购买力平价,有时是一种幻觉。

它只有在国家可以为自己生产许多东西的情况下才有一些意义。就中国而言,他们几乎可以生产任何东西,购买力平价的意义重大。

对于其他国家来说,这只能说明这个国家存在着巨大的贫富差距。